Some Known Details About Paul B Insurance Medigap

Table of ContentsThe Ultimate Guide To Paul B Insurance MedigapNot known Details About Paul B Insurance Medigap

The main factor why Medicare Advantage carriers can provide low to zero-dollar regular monthly premium plans is that Medicare pays the personal companies supplying the plans to handle your health risk. Not all Medicare Advantage strategies have a low premium cost. You can anticipate to pay a copay for every single doctor go to, test, and service you get. Medicare Benefit

medical professional. The Medicare Advantage plan provider will pay the medical professional a set quantity of cash upfront based upon the client's diagnosis. So, the only method the doctor will make an earnings is if they stay under budget plan. The value of a Medicare Advantage strategy depends upon your area, health care requirements, spending plan, and preferences. For some, a Medicare Advantage strategy might be a good monetary investment. If you do not frequently go to medical professionals'visits and are in great health, you could wind up getting more out of the plan than you put in. Simply, Medicare Advantage plans are good till they are no longer helpful for you. If you enroll in a Medicare Advantage plan now, you might have the ability to cancel your Medicare Benefit strategy and register in a Medicare Supplement( Medigap )strategy in the future. To do so, you will have to wait till the Yearly Enrollment Period or the Medicare Benefit Open Registration Period to make modifications. This is your only chance to enroll in a Medigap plan without answering health questions. If you miss this one-time chance to enlist, you will have to respond to health concerns must you want to register in a Medicare Supplement strategy in the future. This indicates the carrier might reject your application due to pre-existing conditions. Are Medicare Benefit plans great or bad? In numerous cases, Medicare Benefit strategies are not the very best protection alternative offered. Eventually, it is essential to understand what

to anticipate from these strategies regarding rate and coverage and end up being educated on which alternatives are economical to you and supply the protection you need. The carriers send their bid based upon expenses per enrollee for medical services Original Medicare covers. Suppose the quote is higher than the benchmark amount. In that case, the enrollee will pay the

difference in the kind of monthly premiums, which is why some Advantage plans have a zero-dollar premium and others have a monthly premium. What is the worst Medicare Benefit plan? The most limiting Medicare Benefit plan in regards to protection, network, and reliability would be an HMO plan. The worst Medicare

advantage plan for you may might be the worst for someone somebody. If you choose to enroll in a Medicare Advantage strategy, you require to ensure that your doctors and hospital will be covered along with a low optimum out-of-pocket limit. MA-PDs comprises a growing share of total Part D registration as more recipients pick strategies with integrated medical and drug benefits. A lot of Medicare Advantage enrollees( 88 %)are in Medicare Advantage prepares that provide prescription drug protection. By integrating prescription drug protection with other Medicare benefits in one plan, MA-PD strategies are able to collaborate care and manage costs throughout both the medical and drug benefits compared to PDPs. In spite of the increasing costs of prescription drugs, Part D plans have been able to use steady premiums to recipients because the program's beginning. While there have actually been significant changes made to the Part D program, there is also increasing interest.

require along with the high-quality, regional care you could try these out you deserve. Can't sign in? Forgot your password? Enter your e-mail address listed below and we will send you the reset instructions If the address matches an existing account you will receive an email with directions to reset your password. The scores are provided each year by the Centers for Medicare & Medicaid Providers

Not known Factual Statements About Paul B Insurance Medigap

, which ranks Medicare health insurance in 5 major categories: Preventive care Persistent care Prescription drug services Customer support Member fulfillment 2023 rankings our medical health insurance score high for quality and service Everybody at Kaiser Permanente

is devoted to offering our members with high-quality care and a better experience and it displays in our regularly high star scores. 5 Stars in Washington, and 4 Stars in Stars in Oregon and Southwest Washington (paul b insurance medigap). [See footnote 4] Get more details Learn more about star quality ratings or view our video" Medicare Star Quality Ratings"to find out more about why they matter when selecting a Medicare health insurance. Discover more about Medicare. The Biden-Harris Administration has made broadening access to health insurance click to investigate and lowering healthcare costs for America's households a leading priority, and today, the Administration is announcing that people with Medicare will see lower premiums for Medicare Advantage and Medicare Part D prescription drug strategies in 2023. In addition, thanks to the Inflation Reduction Act, individuals with Medicare prescription drug protection

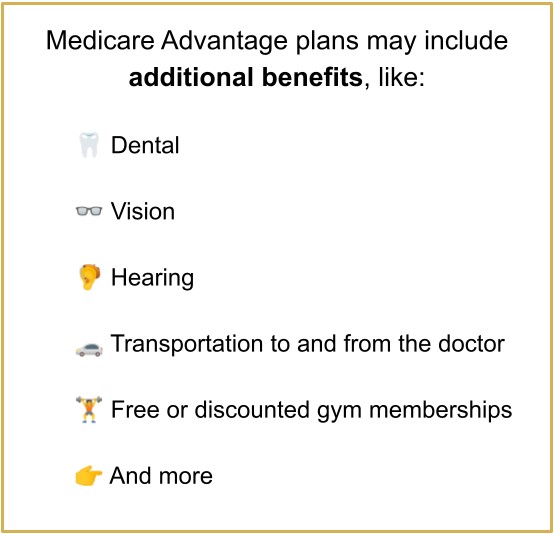

will have enhanced and more affordable advantages, including a$35 cost-sharing limitation on a month's supply of each covered insulin product, in addition to adult vaccines that are recommended by the Advisory Committee on Immunization Practices (ACIP)at no extra expense. The benefits under this design are forecasted to be offered to 6 million individuals. The VBID Design's Hospice Benefit Part, now in its third year, will likewise be offered by 119 Medicare Benefit prepares in portions of 24 states and U.S. territories, supplying enrollees increased access to palliative and integrated hospice care. gov supplies clear, easy-to-use info, along with an updated Medicare Plan Finder, to enable individuals to compare choices for health and drug protection, whichmight change from year to year. Medicare Plan Finder will be upgraded with the 2023 Medicare health and prescription drug plan info on October 1, 2022. Make certain that you understand the additional advantages and any benefits (or flexibilities)that you might lose. You might want to think about: If you can change your current medical professionals If your medications are covered under the strategy's formulary(if prescription drug coverage is provided )The monthly premium The cost of protection. What extra services are used (i. e. preventive care, vision, dental, health club membership)Any treatments you need that aren't covered by the plan If you desire to register in a Medicare Benefit plan, you should: Be eligible for MedicareBe enrolled in both Medicare Part A and Medicare Part B(you can inspect this by describing your red, white, and blue Medicare card )Live within the plan's service location(which is based on the county you live innot your state of house) Not have end-stage kidney illness(ESRD). There are 4 parts of Medicare: Part A, Part B, Part C, and Part D. Part A provides inpatient/hospital coverage. Continued Part B provides outpatient/medical protection. Part C deals an alternate method to get your Medicare benefits(see listed below for additional information ). Part D provides prescription drug coverage. Generally, the different parts of Medicare help cover particular services. It is sometimes called Conventional Medicare or Fee-for-Service(FFS) Medicare. Under Original Medicare, the government pays directly for the health care services you receive. You can see any physician and hospital that takes Medicare (and most do)throughout the nation.